The How and why to use a Bank register book-

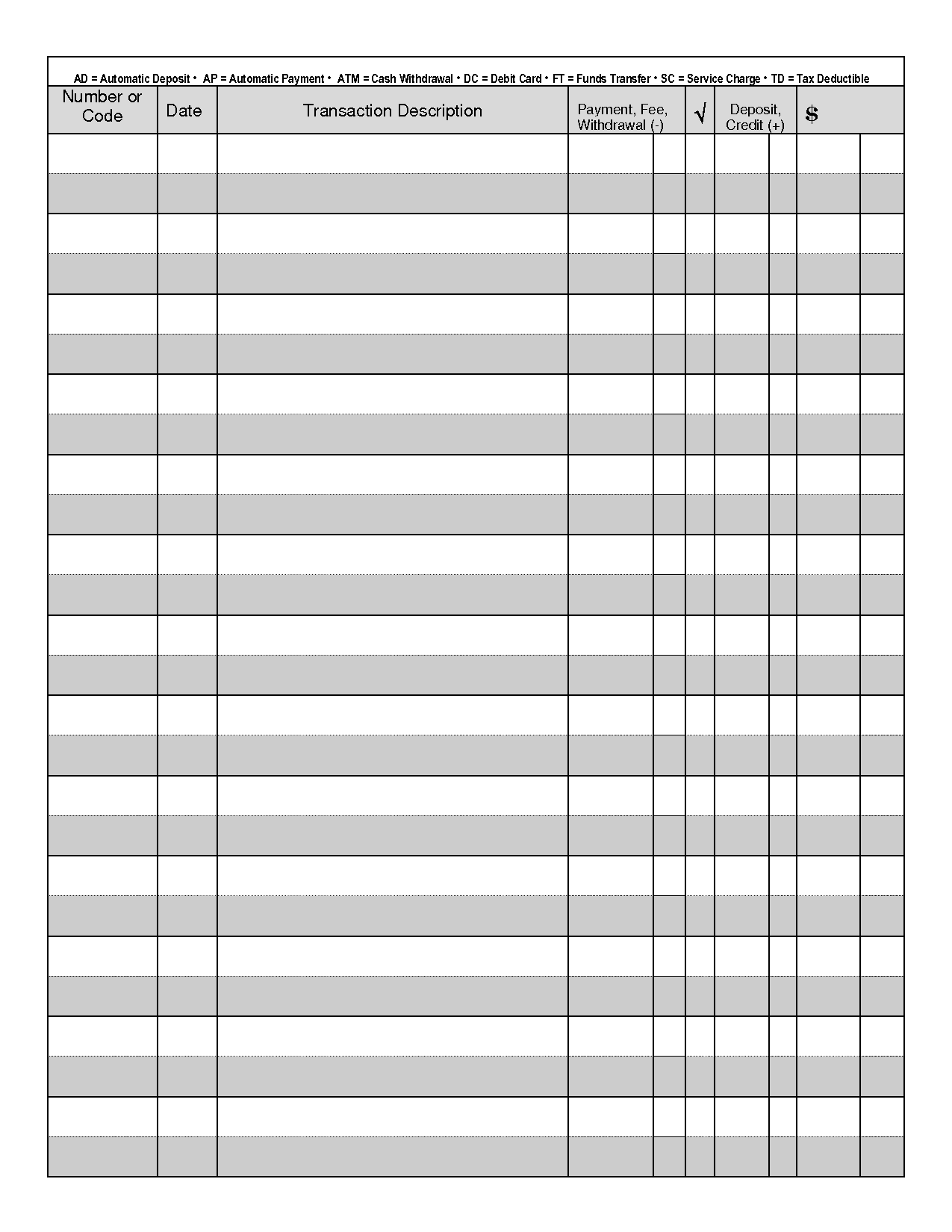

Everyone that I speak to under 30yrs say they don’t use a bank register. What’s a bank register they ask. It’s that little book you get for free when you open a checking account to help you keep track of your money. It’s got grey and white lines going across the book and it’s really not as complicated to use as some think. Here’s a sample of one:

The lines help you keep track of your deposits, any deductions, checks you write, ATM withdrawals, and anything else that happens in your bank account. Let’s not forget those overdraft charges you end up paying for not keeping better track of your correct balance!

But! You say you don’t need a register book because you get an ATM print out of your balance anytime you need to know. So you’re fine, right? Seems like a great idea to just get your balance from the ATM.

But is it?

Is that the best, most accurate way to keep an eye on your money? I can honestly say no.

Now before you get all defensive and start arguing with me, let me explain. So much can go wrong when you only rely on the balance printed from the ATM.

And why is that?

The ATM receipt showing your balance doesn’t take into account any ‘holds’ on your money from places like stores or gas stations where you’ve used your debit card. It also doesn’t show any auto debits you have scheduled that haven’t actually been withdrawn yet. Is that all?

Nope, there’s more.

It doesn’t show any overdraft amounts the bank is charging to your account. It won’t show any interest charged, nor will it show if anyone’s been tampering with your account. (Identity theft anyone?)

What about if I bank online? I can see everything in my account at a moments notice so I’m safe.

Well, that’s a little better in helping you keep a closer eye on your money. But……

Keep in mind that some of those bank items and fees charged to your account won’t show up right away. Why not? Because they’re what’s called “pending”, or “not posted yet” in the banks electronic system. Even though the bank knows they’re going to hit your account balance, the date on those charges haven’t come through so you won’t see them today when you do your ATM balance checking. So when one of them posts to your account, it suddenly overdrafts our account. Maybe that charge was something you did like a purchase that hasn’t caught up with the banks computer to show it. Or it was something bank related that you’d forgotten about. Either way, now your account is in the red.

But if you had used a bank register book, would that have prevented this?

Absolutely!! How could it? Simple really.

When you use the bank register book to record your balance, you immediately deduct whatever is coming due that will be deducted out of your account.(although it hasn’t hit yet, you still deduct it).

Then you will know what your correct balance is at any given time. The true balance, not the imaginary balance the ATM gives you. To make it more clear, here’s an example:

Date: Item charge Withdrawals Deposits Totals

1-1-22 Current Bank account balance(written in your register book) $352.22 1-4-22 Rent(auto debit to be on the 15th) 300.00 -300.00

Balance: $52.22 1-7-22 Gas for work(fill up) 25.00 – 25.00

Balance: $27.22

1-10-22 Payroll Deposit(to post to acct on 11th) 213.77 +213.77

Balance: $240.99

1-10-22 ATM balance (shows $27.22, as your payroll hasn’t posted yet)

1-12-22 bank fee (monthly amount) 15.00 -15.00

Balance: 225.99

1-12-22 ATM balance ck (bank fee not showing but payroll added, so incorrectly shows $240.99)

As you can see from this example, a bank register keeps track of everything. Each item on the next line. The ATM balance checks have been incorrect on two occasions, which would cause you to overspend then get an overdraft fee of $30-50 dollars!!, depending on how many days you stay in overdraft before you realize it and deposit more money. (IF you have any more money to deposit!) What if you don’t have the extra to cover the overdraft fee? Your account is permanently in the red and you will be owing a great deal with every day passing.

If your money is tight now, imagine how much tighter it will be if this keeps happening!

NOTE: What if you accidently overspent thinking the balance was bigger than it actually was, and your rent, mortgage or car payment bounced? You not only owe your original amount which is now overdue, but also bank overdraft fees PLUS late fees for the payment not being on time. AND…….

to make matters even worse, your credit report and scores are going to be hit by this as well. Bye Bye good credit!

All because you didn’t want to take time to correctly keep track of your money in a bank register book. That the banks give to you for FREE. Yikes!

How difficult and time consuming is it really to keep track of your bank account with a bank register book?

It takes about 2min or less to record(that is to write down) whatever transaction is going in or out of your bank account.

Plus, you can plan ahead as you’ll save money in late fees from past due rent/mortgage/payments, AND bank fees.

SAVE $$$ MONEY! That reason alone should be the major reason for using a bank book. If you need more help in keeping a bank register, here’s a tutorial to guide you:

(Tutorial for using a bank book is available on my website for members only.)

Helping you claim Victory over your money woes,

Poni S

Leave a comment